2024 529 Contribution Limits Married Filing Jointly. Starting in 2024, 529 account holders can transfer up to a lifetime limit of $35,000 to a roth ira established for a 529 designated beneficiary. Because contributions to a 529 plan are considered gifts, individuals can contribute up to $18,000 per year to a beneficiary’s 529 account without filing a gift tax return.

Since each donor can contribute up to $18,000 per beneficiary, a married couple can contribute up to $36,000 in a single year per child without needing to file form 709. The potential tax savings below are based on a married couple filing jointly, with an income of $100,000 annually, who contribute $200 per month ($2,400 annually).

2024 529 Contribution Limits Married Filing Jointly Images References :

Source: audyymargarethe.pages.dev

Source: audyymargarethe.pages.dev

What Is The Max Roth Ira Contribution 2024 Married Filing Jointly, Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

Source: fawniaazbridgette.pages.dev

Source: fawniaazbridgette.pages.dev

Hsa Limits 2024 Married Filing Jointly Lida Lilyan, Giving more than the maximum you’re free to gift more than the $15,000 or $16,000.

Source: carlenselena.pages.dev

Source: carlenselena.pages.dev

2024 Ira Contribution Limits 2024 Married Filing Cybil Dorelia, Married couples filing jointly can.

Source: teodorawvida.pages.dev

Source: teodorawvida.pages.dev

Roth Ira Contribution Limits 2024 Married Filing Jointly Per Person, A married couple filing a joint tax return could potentially give up to $32,000 in 2022 without triggering a gift tax.

Source: risabelisabet.pages.dev

Source: risabelisabet.pages.dev

401k Limits 2024 Married Filing Jointly Zoe, You can make 2024 ira contributions until the.

Source: frankymarcela.pages.dev

Source: frankymarcela.pages.dev

Hsa Limits 2024 Married Filing Jointly Penni Blakeley, This strategy is often used for estate planning.

Source: daffieqsamara.pages.dev

Source: daffieqsamara.pages.dev

Edvest 2024 Contribution Limits Laura, Because contributions to a 529 plan are considered gifts, individuals can contribute up to $18,000 per year to a beneficiary’s 529 account without filing a gift tax return.

Source: arethaqmaggie.pages.dev

Source: arethaqmaggie.pages.dev

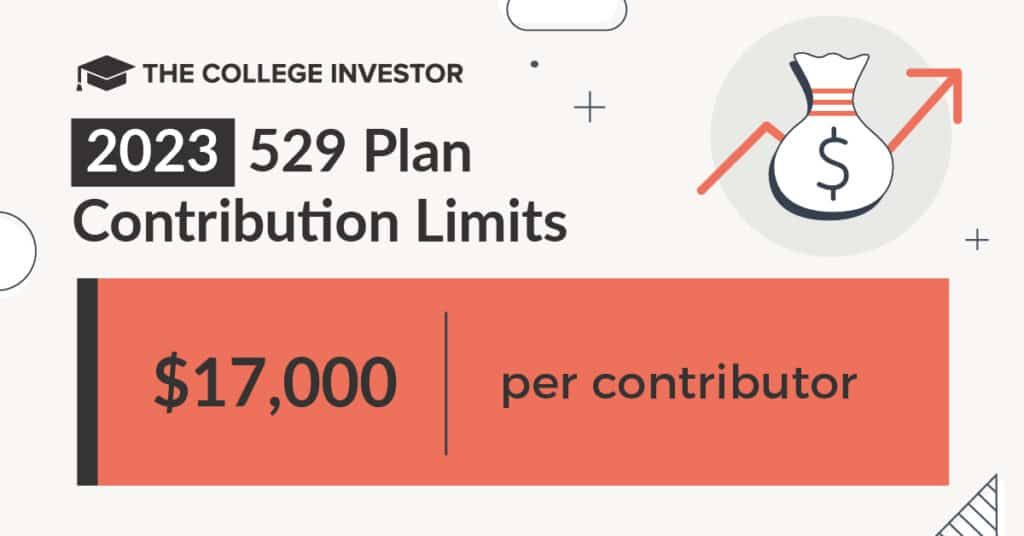

Roth Ira Limits 2024 Married Filing Jointly Karla Marline, In 2023, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you avoid the gift tax.

Source: arielqgianina.pages.dev

Source: arielqgianina.pages.dev

529 Annual Contribution Limits 2024 Dianne Kerrie, Your filing status is married filing jointly or qualifying surviving spouse and your modified agi is at least $230,000.

Source: frankymarcela.pages.dev

Source: frankymarcela.pages.dev

Hsa Limits 2024 Married Filing Jointly Penni Blakeley, Giving more than the maximum you’re free to gift more than the $15,000 or $16,000.

Posted in 2024